What tax will I be charged for Office 365?

Find out what tax you're charged in the following regions. You can also apply for tax exempt status by providing the proper documentation to Support.

Europe, the Middle East, and Africa (EMEA)

When you buy Office 365 services in the European Union, this purchase is subject to Value-Added Tax (VAT).

-

If you're located in a European Union Member State and you do not provide your valid local VAT ID, Microsoft Ireland Operations Ltd. will apply current local VAT rate, based on the billing country your account is set to.

-

If you're located in Switzerland or Liechtenstein, the current Swiss VAT rate is applied, whether you provide your VAT ID or not.

-

Generally, if you're located in an EMEA country outside the European Union and Switzerland/Liechtenstein, VAT is not charged by Microsoft Ireland Operations Ltd.

-

Before we can validate your VAT ID, it must be available for verification in the VAT Information Exchange System (VIES). If your VAT ID cannot be verified, please contact your local tax authority.

You might qualify for VAT zero-rating:

-

If you're in a European Union Member State outside Ireland: You can provide your valid local VAT ID. This will entitle Microsoft Ireland Operations Ltd. to VAT zero-rate the transaction. However, you may have a local VAT accounting obligation, so please check with your tax advisers if you have any concerns. For instructions, see Add your VAT ID (EU countries only).

-

If you're in Ireland and you have relevant valid VAT exemption certification: Microsoft Ireland Operations Ltd. may be entitled to exempt the transaction from VAT. If you don't, Microsoft Ireland Operations Ltd. applies the current Irish VAT rate, whether you provide a VAT ID or not.

Add your VAT ID (EU countries only)

-

In the Office 365 admin center, go to the Subscriptions page, or choose Billing > Subscriptions.

In the Office 365 admin center, go to the Subscriptions page, or choose Billing > Subscriptions.

-

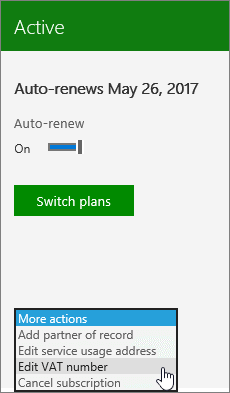

Choose the subscription name, and then choose More actions > Edit VAT number.

-

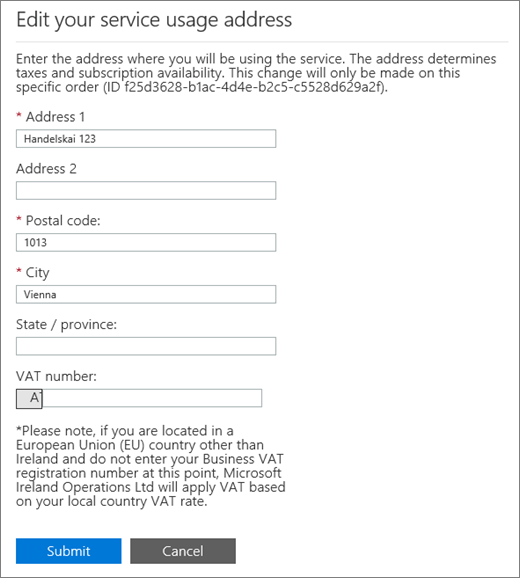

On the Edit your service usage address page, enter your VAT ID in the VAT number box, and then choose Submit.

Asia Pacific countries (APAC)

If you're billed by the Microsoft Regional Sales office, "Microsoft Regional Sales" appears on your invoice, and you're usually not charged a consumption or Value-Added Tax (VAT) tax unless it is a domestic sale.

If you're billed from another location, the current local tax is applied. You'll see the following on your invoice:

-

Singapore to Singapore

-

Korea to Korea

-

Japan to Japan

-

Taiwan to Taiwan

North, Central, and South America

In the United States and Canada, various tax rates apply depending on your location. In Puerto Rico, local Value-Added Tax (VAT) charges apply.

If your billing is done by Microsoft Corporation (see your invoice), and you signed up for Office 365 outside of the United States, Canada, and Puerto Rico, then tax is generally not charged.

Leave us a comment

Were these steps helpful? If so, please let us know at the bottom of this topic. If they weren't, and you're still having trouble, tell us what you were trying to do, and what problems you encountered.

Still need help? Contact support.

Vat Registration

ReplyDeleteValue Added Tax (VAT) Registration is a tax registration required for businesses trading or manufacturing goods in Dubai. VAT Registration replaced Sales Tax in UAE. For more information about Vat Registration then visit here.

Microsoft Office Tutorials: What Tax Will I Be Charged For Office 365? >>>>> Download Now

ReplyDelete>>>>> Download Full

Microsoft Office Tutorials: What Tax Will I Be Charged For Office 365? >>>>> Download LINK

>>>>> Download Now

Microsoft Office Tutorials: What Tax Will I Be Charged For Office 365? >>>>> Download Full

>>>>> Download LINK ub